The Estimate From The Insurance Company

Transparency & Communication – Build a Relationship

The next step in the process is to get the official estimate from the insurance company which identifies what they will pay on this claim. This is where it gets complicated. Most insurance companies will send the estimate using software called often called Xactimate; it breaks down each subcontractor on a room-by-room basis. Their breakdown will often be over 100 pages long. It takes each room of the house and breaks that room down by every line item of your budget that applies.

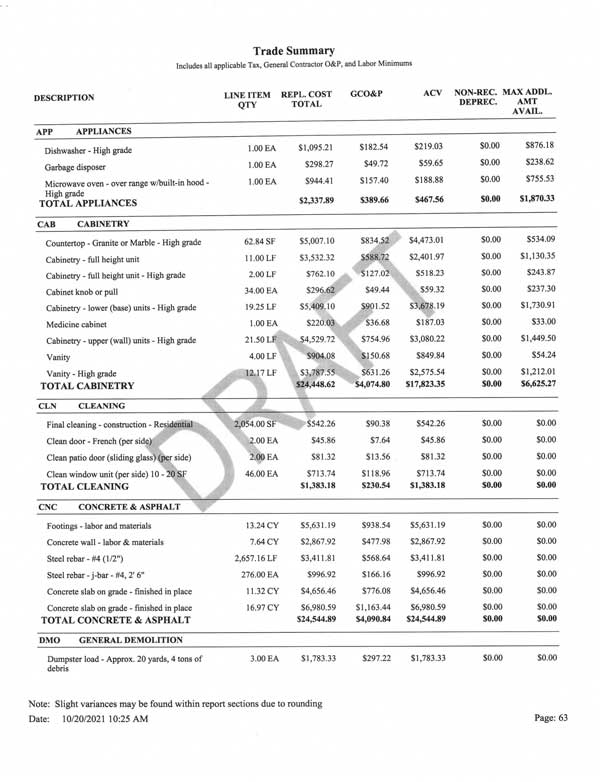

Look towards the end of the estimate for the Trade Summary (or something similar each company is in a slightly different format) this summary will usually break things down by more line items that we are more used to seeing; foundation, cabinets… Click on the State Farm Example or see attachment for an example of the Trade Summary section of their estimate.

NOTE: This initial estimate is always less than the total coverage that they have and less than what it will actually cost to rebuild. This is where you have to push back on what costs are in your area.

The Trade Summary gives a line item breakdown by subcontractor, similar to what we are used to dealing with. Find the column that is RCV (It might also be called the Replacement Cost Total). This stands for Replacement Cost Value, this is the amount the insurer says it will cost to replace the home. This is the insured amount. Usually, they will have other columns like ACV Actual Cash Value and Depreciation. Stay focused on the RCV (or Replacement Cost Total), since you are replacing the structure.

We found almost all the estimates were lower than what it would cost us to rebuild. If you look at the far-right column of the Trade Summary it says “Max Add Amount Avail”; this column is very helpful in identifying those areas where your customer has more money available but the insurance company isn’t willing, yet, to approve. These are important areas to focus on to help your customer get the money needed to rebuild the home they had.

NOTE: These columns and labels will be somewhat different with each insurance company.

Some adjusters tried to get us to change our estimate to resemble their Xactimate – Don’t. Let them know you are a home contractor that doesn’t do insurance work. And that you use the typical line-item breakdown – similar to their trade summary near the end of their estimate. We had a couple adjusters tell me Xactimate is designed for when there is a partial loss to a home, for example when there is a kitchen fire and part of the kitchen is damaged. It works well for that situation where part of the home is still ok and part is damaged. That is why it breaks it down on a room-by-room basis. But it was never designed for natural disasters and doesn’t do a good job when the entire home is destroyed, but it’s all they have to work with.

Use your typical line-item budget when coming up with your estimate to rebuild what they lost. The adjusters we talked to said they are expecting to see a line item of 20% for profit/overhead. It was usually at this stage that I asked my customer to give me permission to talk with their adjusters. This is another VERY important step. Just like all business relationships you have to create a relationship with the adjuster. Ask questions about their estimate; discuss those line items where you are far apart. Talk about how long you have built on the island. Let them know that you are not an out of state contractor coming in to build and take advantage of this situation. Some of the adjusters I personally connected with confided that there is so much fraud with insurance claims that they start from a place where they assume everyone is trying to rip the insurance company off. Once you gain their trust and they understand you’re just trying to get people back in their homes they will work hard to help you. Your relationship with the adjusters is very important. When we did have a problem with an adjuster it would usually be when they were either a new hire or just transferred in from another department to help with the disaster department. With a few adjusters I had to ask to speak to their supervisor to discuss the problem or get assigned to a different adjuster. It was rare but did occur.